PM Images/DigitalVision via Getty Images

Typically, the main advantage of net lease REITs like Realty Income (O) is the consistency of the cash flow, but the downside is that their annual rent hikes are generally limited to just 1-2% per year.

But W. P. Carey Inc. (NYSE:WPC) and VICI Properties Inc. (NYSE:VICI) are exceptions.

They are unique in that they enjoy the consistency and stability of a net lease REIT, but they can still grow at a faster pace because their leases include CPI-based rent escalations.

That makes them particularly attractive if you fear that inflation could remain higher for longer and even accelerate down the line.

Both REITs have strong balance sheets, amazing track records, enjoy highly predictable cash flow from 10+ year-long leases, and their CPI adjustments should lead to steady growth in that scenario.

For these reasons, I have owned both REITs for many years, and they are among my favorite REITs to buy today.

But if I had to only pick one today, which one will it be: WPC or VICI?

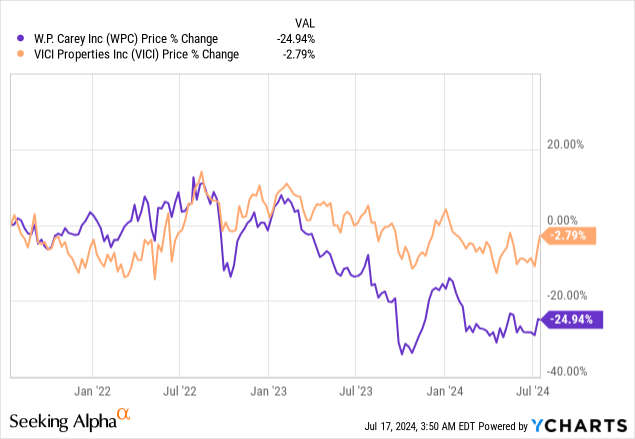

I would pick WPC because of a simple reason: its valuation. It has massively underperformed VICI over the past years and as a result, it is now priced at a historically low valuation relative to it:

Most times, WPC has been priced at a premium relative to VICI because it enjoys many advantages.

- It focuses mainly on industrial properties, which are safer than casinos.

- Its tenant roaster is also far better diversified, reducing risks.

- It also has a stronger investment-grade rating.

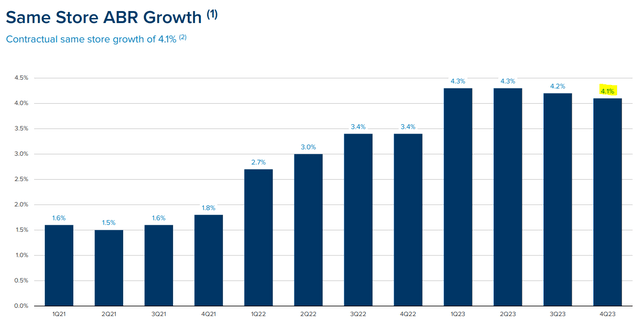

- Even better leases with stronger CPI-based rent escalators.

- A much longer track record.

| WPC | VICI | |

| Portfolio focus | industrial | casinos |

| Biggest tenant exposure | 2.4% | 39% |

| Credit rating | BBB+ | BBB- |

| Rent escalators | Largely uncapped CPI | Largely capped CPI |

| Years as a public company | 26 years | 7 years |

But today, WPC is out of favor and as a result, it is now priced discounted to VICI, which is a very rare occurrence:

| WPC | VICI | |

| P/FFO | 12x | 13x |

| P/NAV | 20% discount | 8% discount |

| Dividend Yield | 6% | 5.5% |

To be fair, VICI has been growing faster recently, and this likely explains why the market is pricing it at a premium. However, it is still odd when you consider all the advantages that WPC enjoys relative to VICI.

The market appears to have overlooked these advantages because WPC has dealt with some headwinds in the past years that have overshadowed its strong organic growth.

It has been winding down its asset management business, which was dilutive to its FFO per share growth, and it also spun off its office properties into a separate REIT, Net Lease Office Properties (NLOP). This reduced its cash flow and its dividend.

This seems to have hurt the company’s market sentiment. I have seen plenty of comments from investors who claim that the REIT is mismanaged because they have failed to grow recently. Many took the unexpected dividend cut as a confirmation that the REIT was uninvestable.

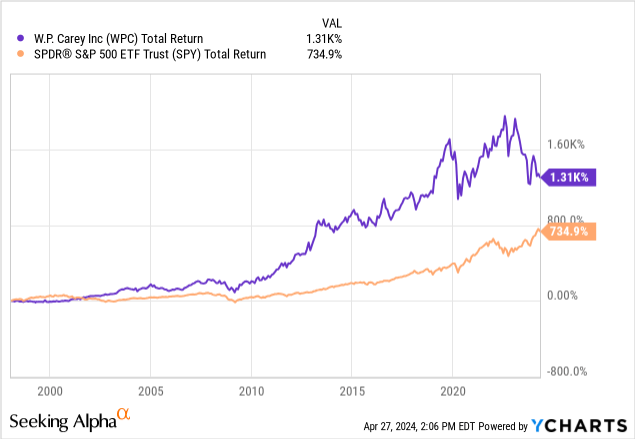

But if you are in that camp, I want to remind you that WPC has been a public company for decades, and it has massively outperformed the broader stock market over the long run, even despite its recent crash. You don’t achieve this accidentally. It requires superior management:

So I don’t buy into the idea that WPC is mismanaged.

In fact, I think that the REIT is very well managed. They have dealt with near-term headwinds, and it has caused their cash flow to stagnate for a few years.

But this is now mostly behind us, and I expect WPC’s growth to accelerate in the coming years. Its same property NOI growth remains far higher than that of its net lease peers, and this will eventually be reflected in its bottom line:

This should serve as a catalyst for the stock as the market realizes that WPC isn’t just a boring no-growth dividend stock.

I think that it could rapidly reprice at closer to 16x FFO, which would unlock about 25% upside from here, and while you wait you also earn a high 6% dividend yield. Even 16x FFO would still be on the low side for a quasi-industrial REIT with a strong investment grade-rated balance sheet.

VICI is also undervalued, but I doubt that it has as much upside potential at this time, and its potential catalysts for that upside also aren’t as clear to me. Its dividend yield is also a bit lower, and the REIT is riskier due to its focus on casinos and its higher tenant concentration.

For this reason, I slightly prefer W. P. Carey Inc.’s risk-to-reward at this time.