Tatjana Meininger/iStock via Getty Images

The Honest Company, Inc. (NASDAQ:HNST), the consumer staples company focused on sustainably and additive-freely manufactured diapers, personal care products, and other products, is going to report the company’s Q2 results on the 8th of August after the market closes. Wall Street analysts are estimating a slow growth from the quarter, coupled with a year-on-year improvement in profitability.

I previously wrote an article on the stock, titled “The Honest Company: Margins Are Getting Healthier.” In the article, I rated the stock at a Hold rating as the valuation came with healthy earnings growth expectations amid recent quarters’ profitability improvements. After the article was published on the 21st of May, the stock has returned 21% compared to the S&P 500’s near-stable positive performance of 1%.

My Rating History on HNST (Seeking Alpha)

Upcoming Q2 Results: Modest Growth Expected, But Watch Profitability Closely

The Honest Company is reporting the company’s results on Thursday. Wall Street analysts estimate revenues to reach $87.1 million at a year-on-year growth of 3.0%, along with an EPS of -$0.05 as the company’s fixed costs still outweigh gross profit from sales.

The growth estimate of 3.0% seems fair, as The Honest Company reported a very similar 3.4% growth in Q1. Procter & Gamble (PG), the most notable large-scale competitor in The Honest Company’s product categories, has already reported its results from the April-June period. They showed a -1% organic sales growth in its Baby, Feminine & Family Care segment driven by stagnant pricing and slight negative volumes, and a 3% organic growth in the Beauty segment from 1% organic volume growth and a 3% price increase. Procter & Gamble’s results also showed a very comparable sequential performance from the January-March period’s segment performances, albeit with a worse price performance but better volume growth in the latter quarter.

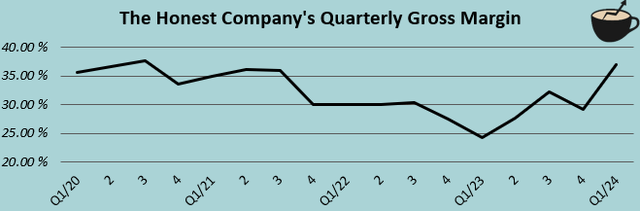

The expected profitability is more important in my opinion, as I previously highlighted recent margin expansion and its importance. The -$0.05 EPS expects a notable $0.09 jump from the prior Q2, but a -$0.04 decline sequentially – The Honest Company’s incredibly good gross margin in Q1 is expected to normalize downwards after several impressive quarterly improvements.

Author’s Calculation Using TIKR Data

I believe that The Honest Company has some potential for a profitability beat as the great gross margin expansion is driven by renegotiated product and logistics contracts (600bps in Q1 y/y) and good pricing increases (275bps in Q1 y/y), as told in the latest quarterly earnings call. Wall Street’s estimates seem to model profitability along The Honest Company’s remaining guidance of “low to mid-single digit a million positive adjusted EBITDA” in 2024, which could well be revised upwards in my opinion if recent margin improvements last with the Q1 adjusted EBITDA of $2.6 million.

When asked about the reaffirmed guidance range in the Q1 earnings call, The Honest Company’s CFO Dave Loretta said that the company wants to be cautious. This was because it was early in the year and some uncertainties exist in the space, with the next couple of quarters showing a better roadmap. The call’s remarks also could hint for a better-than-expected profitability in the rest of the year.

Procter & Gamble did show worse pricing power in the Q2 period than in Q1 in the Baby, Feminine & Family Care segment, though, providing some reason for caution for the upcoming Q2 report as well.

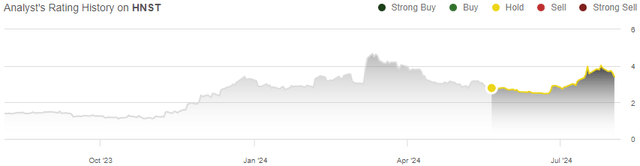

The Stock is Getting Better Wall Street Recognition

As a positive sign, The Honest Company was upgraded into a Buy rating at Loop Capital in late June, with analyst Kayra Champine relating to the company’s solid growth, improving profitability, and healthy balance sheet. Loop Capital sees prices increases alone driving a 2% revenue growth, expecting greater growth in coming quarters than the consensus anticipates.

HNST’s Valuation Remains Fairly Balanced with Revised WACC

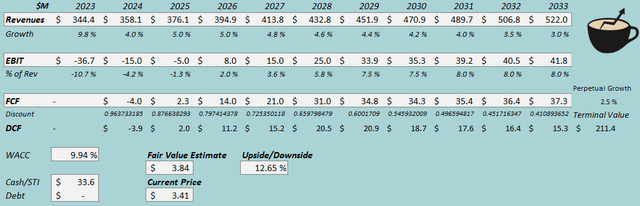

I’ve made no updates to the discounted cash flow [DCF] model in terms of the cash flow estimates; for explanations of the factors behind the estimates, I refer to my prior article on the company.

DCF Model (Author’s Calculation)

The estimates put The Honest Company’s fair value estimate at $3.84, 13% above the stock price at the time of writing. The estimate is up significantly from $2.46 previously due to the lower used WACC.

CAPM

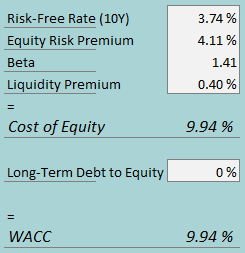

A weighted average cost of capital of 9.94% is used in the DCF model. This is down from 13.56% previously due to a lower risk-free rate, equity risk premium, and beta. The market now requires smaller estimated returns, and I revised the beta estimate from a previously highly conservative level into a less conservative updated estimate.

The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

I continue estimating no debt. To estimate the cost of equity, I use the 10-year bond yield of 3.74% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I now use Seeking Alpha’s current beta estimate of 1.41 down from the used 1.90 beta previously, as the consumer staples sector should achieve a low beta although The Honest Company’s currently low margin profile does warrant a higher risk estimate. With a liquidity premium of 0.4%, the cost of equity and WACC stand at 9.94%.

Takeaway

The Honest Company is going to soon report its Q2 results, reporting likely moderate growth and improving year-on-year profitability. I believe that profitability is the more important metric to look at. With the apparent gross margin expansion in Q1 from persistent factors, I believe that The Honest Company, Inc. could potentially report a consensus beat in the EPS that is expected to show a sizable sequential decline. As the valuation remains fairly balanced, I remain with a Hold rating for The Honest Company.