Ashi Sae Yang/iStock via Getty Images

Introduction

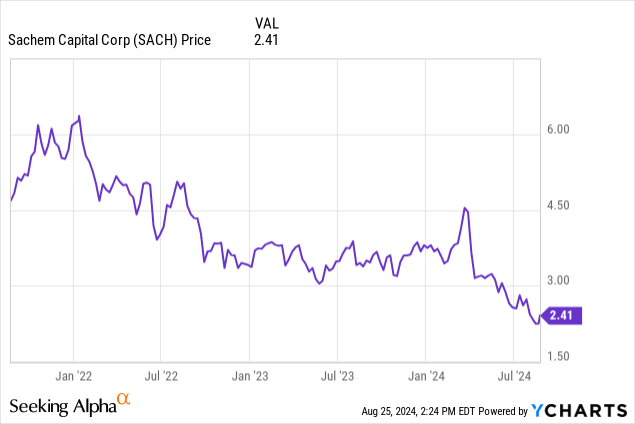

I have been keeping track of Sachem Capital (NYSE:SACH) for several years now as I like the REIT’s business model: it invests in short-term loans secured by first mortgage liens on the buildings while there tends to be additional collateral provided by the borrower as well. That being said, it is abundantly clear these are tough times for the commercial real estate space and Sachem recently had to cut its dividend on the common shares. That didn’t really come as a surprise as in my March article, I mentioned I was avoiding the common shares (which have lost in excess of 40% of their value since that article). That being said, I still have a long position in most of the REIT’s baby bonds as I like the risk/reward of those debt securities.

The second quarter wasn’t great, and that’s why I prefer to be a creditor

As the REIT recently published its Q2 results, I think that provides an excellent starting point to discuss the current situation of the baby bonds as my main concern is obviously making sure Sachem continues to make the interest payments and doesn’t default on its debt.

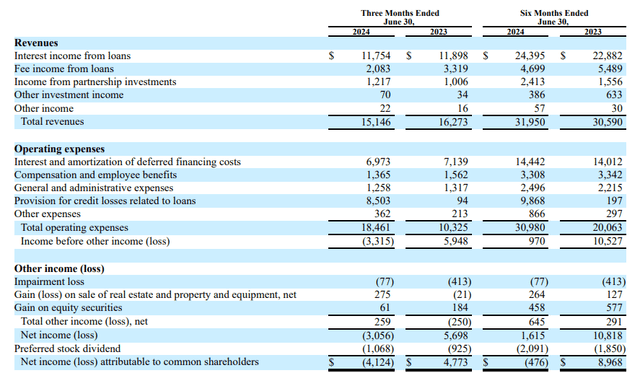

In the second quarter of this year, the REIT reported a total revenue of $15.15M while the operating expenses jumped to $18.5M resulting in an operating loss of around $3.3M. That being said, this includes a $8.5M provision for credit losses which is almost 100 times higher than the provision recorded in the second quarter of last year, while it also is substantially higher than the $1.3M recorded in the first quarter of this year.

This means that on an underlying basis, the operating income was approximately $5.2M and after deducting the $1.1M in preferred dividends, the net profit attributable to the common shareholders would have been around $4.1M instead of the $4.1M loss.

Of course, those loan loss provisions don’t just magically disappear. But that’s why I’m perfectly happy to be a creditor rather than a shareholder. When the loan quality decreases, the common equity as well as the preferred equity are the first to absorb the losses.

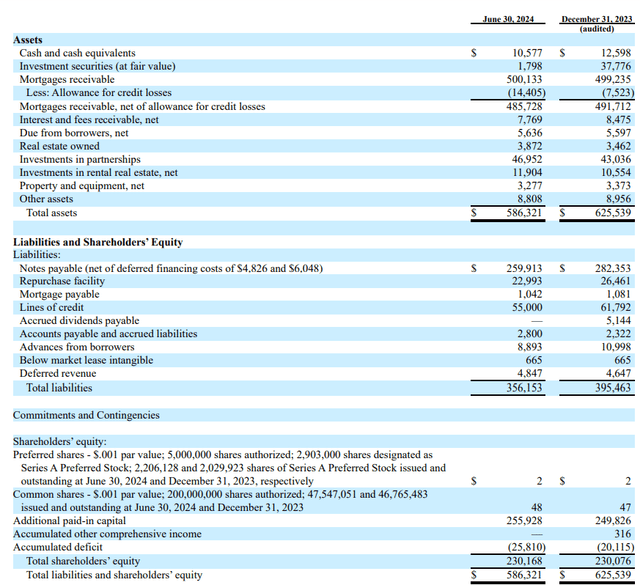

And this brings us to the REIT’s balance sheet. As you can see below, Sachem has a total of $586M in assets, funded by $356M in liabilities while the total amount of equity on the balance sheet was approximately $230.2M. This means that when the REIT loses on its investments, there is a cushion of $230M to help absorb those losses before the creditors should start to get nervous.

An additional positive feature of the baby bonds is the fact the REIT actually increases its equity cushion. During the second quarter, the REIT issued almost 100,000 preferred shares and just over 101,000 common shares bringing the total H1 issuance to 176,000 preferred shares and just under 570,000 common shares for total proceeds of $5.7M in total. So while shareholders and preferred shareholders get diluted (the dilution on the preferred equity level mainly consists of weaker coverage ratios), the owners of baby bonds are in a good position.

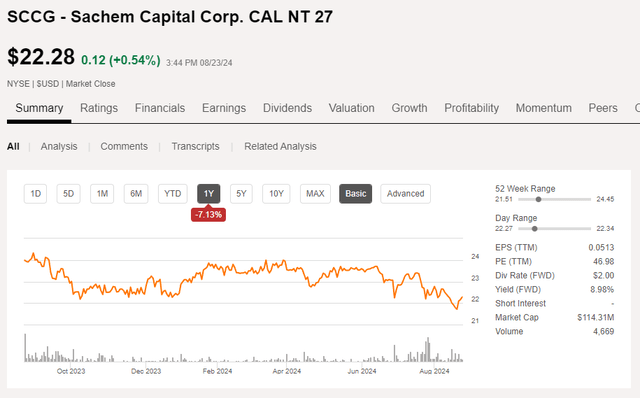

I wanted to add duration to my portfolio, so I recently added to my position in (NYSE:SCCG), Sachem’s 2027 notes with an 8% coupon. That specific baby bond is trading at $22.28 per unit, and matures at the end of September 2027, so 3 years and 1 month from now.

This results in a yield to maturity of just over 12% which I think provides a good compensation for the risk. The baby bonds with an earlier maturity date are trading at lower yields to maturity with for instance SCCC which matures in September 2025 trading at a yield to maturity of around 8.5% as the market is relatively ‘sure’ Sachem will be able to repay the baby bonds closer to maturity.

In fact, on the conference call, the Sachem management mentioned it had about $30M in cash available thanks to some repayments and it was considering calling the 2024 baby bonds early. But by investing in baby bonds that only mature in 2027, you are basically betting on the REIT still being around by then.

And I like those odds (despite $106M in non-accruing loans and about $73M in foreclosure status), mainly because this management team is now doing the right thing by not issuing new debt that would have a double digit coupon, but instead focusing on the existing balance sheet. From the Q2 conference call:

And as such, we’ve kind of backed away from raising, we call it, inefficient debt. It’s best for us to perhaps shrink our balance sheet and wait for better opportunities in the debt markets when a deal doesn’t fit the box, right?

It will be very interesting to see what Sachem Capital can salvage from the foreclosed loans as that will provide a good indication of what we can expect going forward. And if it for instance receives 60 cents on the dollar, it can use the $45M to start calling some of its baby bonds (or buy them back on the open market if it is allowed to do so).

The main issue right now is the unpredictability of the markets. Or as highlighted in the conference call:

Hey, just yesterday, we received $2.25 million on a loan, an industrial property. They didn’t pay in nine months, full pay. Those things happen.

This is a tough environment to do business in, and I like the REIT’s strategy to play defense and let the dust settle.

Investment thesis

Decreasing interest rates on the financial markets should help Sachem as it will reduce the pressure on its borrowers and make (foreclosed) assets more interesting to prospective buyers. It’s also important to note that while having a non-performing loan ratio of almost 20% is really high, most of the loans have a LTV ratio of less than 50%. And even if the fair value is even lower than that, the equity will absorb the first losses.

I’m willing to take the risk Sachem Capital will still be around in 2027 as I like how the management is dealing with the current situation. It called off a debt offering when the terms would have been too onerous while it prefers to shrink the balance sheet rather than pursuing new deals during this era of uncertainty. And as a creditor, I also like the REIT’s strategy to keep on printing more shares and preferred shares as those rank senior to my baby bonds.