Klaas Jan Schraa/iStock Unreleased via Getty Images

Introduction

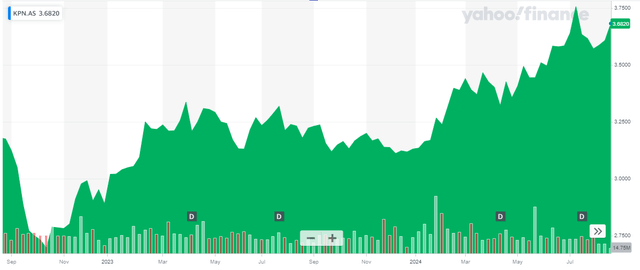

It’s been more than six months since I last discussed Koninklijke KPN (OTCPK:KKPNF) (OTCPK:KKPNY), the Dutch phone and telecommunications company. Earlier this year, I was charmed by the company’s plan to boost its cash flows on an annual basis for the next few years, which should ultimately result in higher dividends. Unfortunately (not that I’m complaining), the share price has moved up by approximately 16.8% since the previous article was published while KPN also paid a dividend to the tune of 9.8 cents for a total return of almost exactly 20%. As the Dutch company recently published its semi-annual report, I thought this could be a good moment to have another look at my investment thesis to see if it needs any fine-tuning.

Yahoo Finance

KPN’s listing on Euronext Amsterdam is the most liquid listing. The company is trading in Amsterdam with KPN as its ticker symbol and the average daily trading volume is almost 10 million shares. As the company continues to buy back stock, there currently are approximately 3.9 billion shares outstanding, current market capitalization is approximately 14.4B EUR.

The company remains on track to meet the 2024 outlook

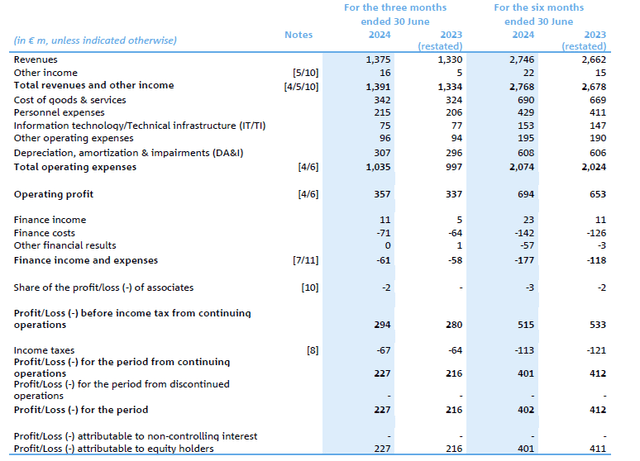

In the first half of this year, KPN reported total revenue of 2.75B EUR, an increase of just over 3% compared to the first half of last year. Additionally, as the “other revenue” also increased, the total reported revenue was 2.77B EUR, a 3.3% increase compared to the first half of last year.

KPN Investor Relations

And just like so many other companies in Western Europe, KPN also had to deal with an increasing cost of labor as personnel expenses increased by just over 4% while the amount of COGS also increased by about 3%. Again, not a major surprise, and looking at the income statement, most of the operating cost increases are really in line with the recent inflation numbers so it’s not like anything really stands out.

Thanks to the higher revenue, which more than offset the higher operating expenses, the operating profit increased by just over 6% to 694M EUR, which, I think, is a very decent result. Additionally, the company was able to keep its net interest expenses under control, but there was a non-recurring “other financial expense” that was recorded in the first quarter and still weighed on the H1 results. That’s why the reported net profit decreased by about 3% from 412M EUR to 401M EUR, representing an EPS of 0.10 EUR per share. But as you can see on the image above (the income statement), the Q2 net profit was a much better 227M EUR as the non-recurring finance item (related to a bond tender and the unwinding of certain swaps) indeed didn’t reoccur in the second quarter.

In the January article, I zoomed in on the company’s cash flow performance for two reasons: I wanted to make sure KPN didn’t have to deal with a sudden capex surge. Secondly, the company pays a relatively attractive dividend and continues to buy back stock, and I want to make sure it generates a sufficient amount of cash flow to fund these shareholder rewards.

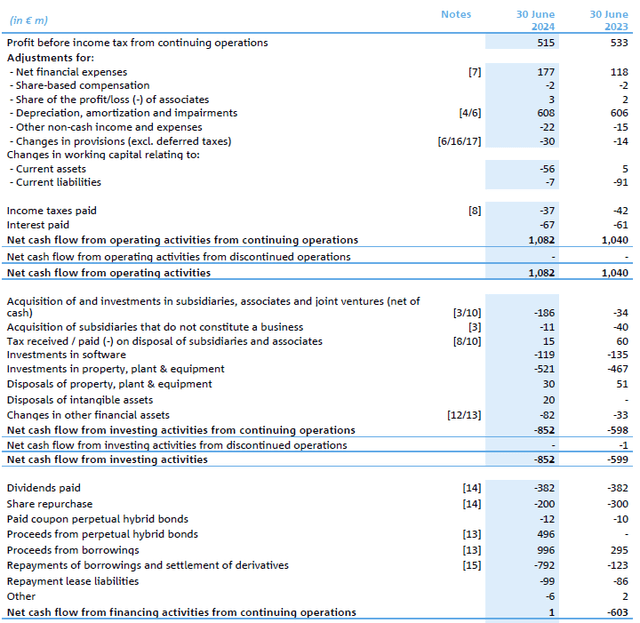

The reported operating cash flow was 1.08B EUR, as shown below, but we should add back the 63M EUR in working capital investments but deduct the 111M EUR in hybrid coupon payments and lease payments. Additionally, the company only paid 37M EUR in cash taxes, although the income statement shows it owed 113M EUR. Adjusting the reported operating cash flow for these elements results in an adjusted operating cash flow of 958M EUR.

KPN Investor Relations

We also see the total capex (excluding M&A related items and investments in subsidiaries and associates) was approximately 640M EUR. This results in an underlying free cash flow of around 318M EUR, or just over 8 cents per share.

That’s indeed lower than the reported net income, and the explanation is rather simple: During the first semester, KPN spent almost 740M EUR on capex and lease payments, while the total depreciation was just 608M EUR. This 132M EUR difference represents in excess of 3.3 cents per share.

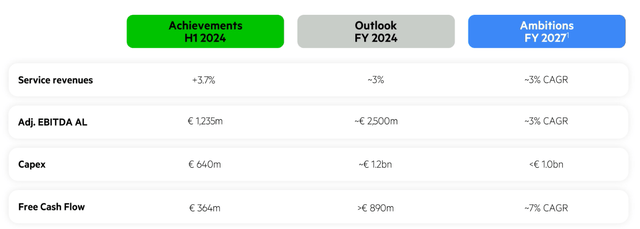

That’s not entirely unexpected as the company is guiding for a full-year capex of 1.2B EUR (indicating the second half of the year should include a lower total capex spend of around 560M EUR). But more importantly, as you can see below, the total capex number will trend down toward 1B EUR in 2027. At that point, the total capex + lease payments will be pretty close to the depreciation and amortization expenses.

KPN Investor Relations

Meanwhile, the net free cash flow should also increase due to the anticipated EBITDA increases. KPN still aims to increase its revenue and EBITDA after leases by about 3% per year. Based on the 2.5B EUR guidance for 2024, this implies a total EBITDA after leases of about 2.73B EUR, a 230M EUR increase versus the anticipated result this year.

Meanwhile, the free cash flow should increase by about 7% per year and using this year’s 890M EUR as a starting point, this implies a FY 2027 free cash flow of around 1.05B EUR (using a CAGR of just under 6% as I’m a tad bit more conservative).

As KPN continues to buy back its stock, I like the odds of seeing a total share count of less than 3.7B shares by 2027 in which case 1.05B EUR in free cash flow would represent a net free cash flow of just over 28 cents per share.

Investment thesis

KPN remains on track to achieve the midterm guidance it provided on its capital markets day in the final quarter of last year. I see no reason why the company wouldn’t be able to report a total free cash flow of 0.28-0.29 EUR per share in 2027, which should also have a positive impact on the proposed dividend. For this year, KPN is guiding for a dividend of 0.17 EUR per share (which would be a 14% increase compared to last year), subject to a 15% Dutch dividend withholding tax.

I am, however, close to considering moving from “buy” to a “hold” after the share price increase in the past few months. The stock is now already trading at a forward free cash flow yield of around 7% based on the 2027 projections, and the only reason it perhaps still is a buy is for its dividend (growth) potential. The current yield of 4.6% is attractive, but I expect the dividend to continue to increase in line with the free cash flow performance of the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.