JHVEPhoto/iStock Editorial via Getty Images

I wasn’t thrilled with First Hawaiian’s (NASDAQ:FHB) immediate prospects when I last covered this bank back in March. The worst of its top line pressure was definitely behind it, but the outlook for revenue was still pretty flat, with management guidance of mid-single-digit growth in core operating expenses ultimately implying fairly weak earnings.

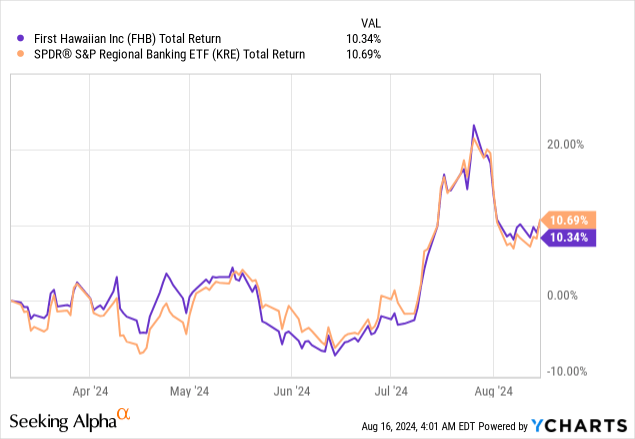

The stock has actually done okay since then. Regional banks have pulled back a bit in recent weeks, but a roughly 10% total return in less than six months isn’t bad by any means, with that result basically matching the performance of the peer group.

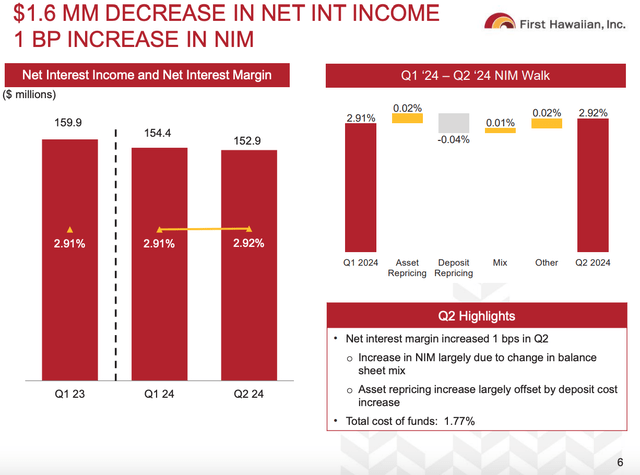

Things are also going largely as expected at the business level. Net interest margin (“NIM”) has been a touch stronger than initial guidance, but lower earning asset balances mean that net interest income (“NII”) is still quite weak. Expenses are landing about in line with expectations, so earnings are essentially flatlining.

Looking ahead, First Hawaiian remains slightly asset sensitive as we head towards the first interest rate cut of this cycle, and that will result in some near-term pressure on NII and NIM. Balance sheet dynamics should take over eventually, though, and this should result in an overall tailwind on a longer-term basis.

As for the stock, I still think it can appeal to a certain category of investor, albeit paying 13.5x consensus 2025 EPS isn’t going to lead to riches any time soon. With little to get excited about in the near term, I leave my ‘Hold’ rating in place.

Few Surprises In H1 Results

First Hawaiian reported net income of $116.1 million, or $0.91 per share, for the first half of the year, which was down around 10% year-on-year. While the bank has seen earnings erosion due to funding cost pressure, it is important to point out that it remains well above-average in terms of profitability, with H1 net income still good for a 15.5% return on tangible equity.

I would also add that First Hawaiian has held up relatively better than recently-covered peer Bank of Hawaii (BOH). Both have clocked in relatively similar (and solid) deposit betas in this cycle (somewhere in the low-30s percent area), which isn’t all that surprising considering they are the two main players in a concentrated banking market. First Hawaiian has produced a meaningfully better earning-asset beta, though, which has helped cushion the blow to income. With that, pre-provision operating profit was ‘only’ down by around 5% year-on-year here last quarter, much better than the circa 25% year-on-year decline posted by BOH.

Source: First Hawaiian Q2 2024 Results Presentation

NIM has also performed better than initially expected at previous coverage, landing at 2.92% in Q2. That was up around 1bps year-on-year and quarter-on-quarter, and better than the mid/high-280bps region guided last time. However, with earning asset balances down, NII remains pretty tepid, falling by another 1% sequentially last quarter to $152.9 million.

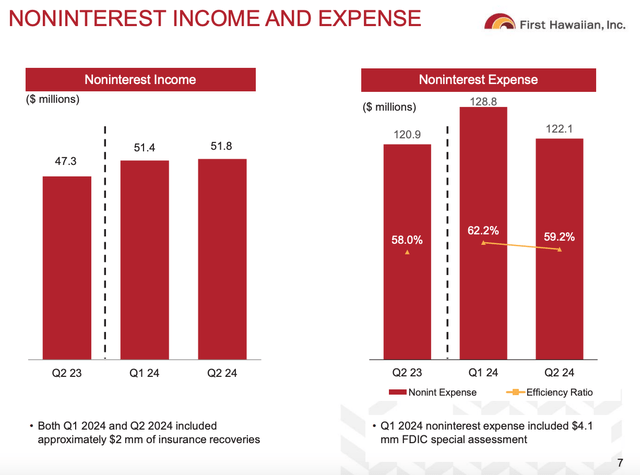

Source: First Hawaiian Q2 2024 Results Presentation

There were few surprises elsewhere. H1 non-interest income of $103 million was basically in line with the $49-$50 million per quarter initial guidance provided by management, while operating expenses of $250 million likewise means the bank is on track to meet full-year guidance of $500 million. Credit quality remains a non-issue, with nonperforming assets still flat at just 0.15%.

The Outlook

The forward path for interest rates has obviously been a hot topic recently, with the market seemingly oscillating between ‘higher for longer’ and ‘cuts now’. First Hawaiian does remain asset sensitive as things currently stand. That is to say, its assets reprice faster than liabilities, leading to growing NII when rates rise and the opposite when rates fall. The bank’s latest interest rate sensitivity disclosure had the magnitude of that decline at around 1.2% in the first 12 months following a shock 50bps fall in interest rates. Management also confirmed on the Q2 call that NIM is expected to decline following a rate cut:

So, from a NIM perspective, I guess I would say that we expect the trajectory of the NIM to continue to rise, but if there is a rate cut just on an absolute level, the NIM will decline in the quarter that there is a rate cut. We still do have a slightly asset-sensitive balance sheet.

Jamie Moses, First Hawaiian CFO

This is seen leading to a near-term fall in NII, as per the CFO’s response to a follow-up question on the matter:

Right. So, net interest income, that’s — yeah, sorry about that, Steve. So, that will be dependent upon loan growth, continued rotation out of securities and into loans that could help us grow NII. But, on an apples-to-apples basis, the NII would decline in that scenario.

Jamie Moses, First Hawaiian CFO

There are a couple of points to consider on this. Firstly, yes, this is likely to amount to a near-term headwind based on the current forward curve. That said, interest rate sensitivity models really are just models, meaning they are only as good as the assumptions that feed into them. Some of those assumptions, such as a static balance sheet, are never going to play out, while others, such as deposit behavior, naturally have a subjective element baked into them.

More importantly, I still expect First Hawaiian’s balance sheet dynamics to take over in the long run, and this should ultimately be a tailwind to NIM. The bank still held over $6 billion in investment securities at the end of Q2, with these earning a blended rate of just 2.15%. Given where interest rates are currently, investing maturities in just about anything would result in a material pick-up in yield. That will still be true even if rates fall in line with the forward curve, as pointed out by management earlier in the year:

We feel pretty good about where we are at, even in a down rate scenario, say, 100 basis points down, 200 basis points down, that is still a net positive action with replacing securities portfolio and running off the time deposits.

Jamie Moses, First Hawaiian CFO

Having said that, securities are only running off at around $150 million per quarter, so this is very much a longer-term effect. I would note that sell-side analysts are still only pencilling in 2025 EPS of $1.73, which is around flat compared to 2024 consensus and 6% below actual 2023 EPS of $1.84.

Valuation

First Hawaiian shares trade for $23.38 as I type, equal to around 13x consensus 2024 EPS and 13.5x 2025 consensus. Versus Q2 tangible book value of $12.16, the stock trades for a multiple of 1.92x.

Over the long run, I would be looking for a circa mid-teens ROTE and around 3% annualized growth to make that work at the usual 9-10% hurdle rate. While I do expect the bank to deliver that given enough time, this isn’t a 2024 or even 2025 story as things stand, and I think investors looking at these shares today need to be prepared to hold them for the long haul.

Summing It Up

2024 is going largely as expected for First Hawaiian, with most key P/L lines basically in line with initial guidance. Rate cuts look likely to be a slight headwind given the bank’s modest asset sensitivity, though balance sheet dynamics offer a more positive outlook over longer-term horizons.

As for the stock, that really depends on what kind of investor you are. Those looking for a beaten-down bank to trade through the cycle will find much better choices elsewhere, while longer-term “buy and hold” types may be content to accept an uninspiring near-term outlook in exchange for First Hawaiian’s above-average profitability and no frills through-the-cycle offering.