syahrir maulana

Market Commentary Team

In the second quarter of 2024, US equity market performance showed a mixed landscape. While the broad-market Russell 3000 Index and the large-cap-focused Russell 1000 Index advanced approximately 3%, most other market segments posted negative returns. Moving down the cap spectrum, the Russell Midcap Index and Russell 2000 Index each declined by roughly -3%. From a style perspective, growth indices continued to outperform value indices significantly. The Russell 1000 Growth Index increased by 8%, whereas the Russell 1000 Value Index decreased by -2%. Similarly, the Russell Midcap Growth and Value indexes both fell by around -3%, with the Russell 2000 Growth Index down -3% and the Russell 2000 Value Index falling nearly -4%.

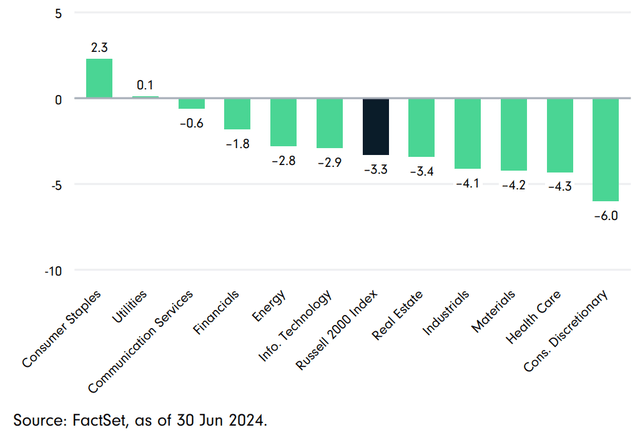

2Q24 Russell 2000 Index Sector Returns (%)

From a sector perspective, only consumer staples (+2.3%) and utilities (+0.1%) were in the black in Q2. Their relative resilience is likely due somewhat to a growing preference among investors for more defensive sectors as the economic and market cycles get increasingly long in the tooth. Conversely, consumer discretionary (-6.0%) led the way down, followed by health care (-4.3%), materials (-4.2%), industrials (-4.1%) and real estate (-3.4%). Information technology (-2.9%), energy (-2.8%), financials (-1.8%) and communication services (-0.6%) were also in the red.

As has been expected for several months, monetary policy among major central banks diverged in Q2 as the European Central Bank cut rates while the Bank of England and the Federal Reserve held. Further, Fed chair Jerome Powell maintained his position that US rates are likely to remain higher for longer, signaling that there is expected to be only one rate cut before the end of the calendar year. Given the US’s economic resilience — exemplified by resilient employment numbers — and inflation’s ongoing stickiness, Powell’s commitment is not particularly surprising. What naturally remains to be seen is how durable the economic data prove to be in the coming months.

While we’ve seen a narrowing of the market in the largest market cap segments, the small-cap arena continues to provide compelling investment opportunities. Our focus on intrinsic value investing allows us to identify resilient businesses within the small-cap universe that may be easy to miss when they aren’t necessarily on the obvious front page of the latest headlines. This environment is increasingly interesting for deploying our time-tested, fundamental approach to uncovering good investment opportunities that we believe can deliver excellent outcomes for the long term.

Performance Discussion

Our portfolio slightly trailed the Russell 2000 Index in Q2. Relative strength was concentrated among our materials holdings, which nicely outpaced benchmark peers. Conversely, our health care, financials and consumer staples holdings detracted from relative performance.

On an individual holdings basis, among our top Q2 contributors were FTAI Aviation (FTAI) and United States Lime & Minerals (USLM). Transportation infrastructure company FTAI Aviation notched two important wins in Q2: It launched a maintenance, repair and exchange (MRE) program for the V2500 aircraft engine, and it signed a deal with Pratt & Whitney to gain access to original equipment manufacturer (OEM) parts. Combined, these agreements further solidify FTAI’s position as a full-fledged MRE competitor in aerospace engines — it now provides service offerings on both narrowbody engine programs, which have the largest installed base of all commercial aerospace engines.

United States Lime & Minerals manufactures and supplies lime and limestone products to a variety of construction and industrial customers. In Q2, reduced construction industry demand was offset by increased industrials demand, which, combined with a favorable limestone pricing environment, contributed to record revenue and operating margins. Looking forward, we expect the company to benefit from its favorable regional position along the I-35 corridor, supporting economic expansion and infrastructure development from Oklahoma City, OK, to the Texas triangle of Dallas, San Antonio and Houston.

Other top Q2 contributors included Mama’s Creations (MAMA), Rocky Brands (RCKY) and Taseko Mines (TGB). Prepared foods company Mama’s Creations is making progress with its endeavor to create a one-stop, deli-solutions business under the leadership of its new management team and new CEO, Adam Michaels. Shares of footwear and apparel designer and manufacturer Rocky Brands rose amid a combination of rising underlying demand for its products, improved wholesale orders and well-controlled expenses. Mining company Taseko Mines is benefiting from its exposure to copper — which is in demand as electrification requires significant access to copper supplies. The company was also able to resolve a labor dispute at its newly acquired Gibraltar mine during the quarter.

Among our bottom Q2 contributors were Red Rock Resorts (RRR) and Enovis Corporation (ENOV). Red Rock Resorts, a casino operator controlling over half the Las Vegas locals market, is facing some concerns about the near-term competitive environment. However, we maintain our conviction in the business’s long-term underlying fundamentals and anticipate it will actually take market share.

Shares of innovative medical technology company Enovis were pressured amid some short-term headwinds related to the integration of a recent acquisition. While some were quick to conclude the boost Enovis and the medical technology industry overall received from a COVID-era backlog of surgeries is winding down, we believe Enovis remains well-positioned to continue taking share as it cross-sells new products. Further, we believe the market is undervaluing the company’s ability to use its continuous improvement-focused business system to drive above-market organic growth, make accretive acquisitions and meaningfully expand margins over the long term.

Other bottom Q2 contributors included Live Oak Bancshares (LOB), Allegiant Travel (ALGT) and Allient (ALNT). Shares of regional bank Live Oak Bancshares were pressured as a higher-for-longer interest-rate environment impacted customers and, in turn, affected the company’s balance sheet. Regional airline Allegiant Travel underperformed amid further delays in the delivery of its new Boeing 737M fleet. Designer and manufacturer of precision and specialty-controlled motion components and systems, Allient, faced a mixed-demand environment in Q2 as supply normalized and demand weakened in pockets of Europe. Looking forward, we expect the company to benefit from its end-market diversity as order backlogs firm up and channel inventory corrects. Further, Allient is undertaking an efficiency program to integrate recent acquisitions and better align its operating structure to support growth and margin expansion in the coming years.

Portfolio Activity

We continue finding attractively valued, resilient companies the market is overlooking amid its increasingly narrow focus on the mega-cap technology stocks dominating the major indices. In Q2, we initiated new positions in Magnolia Oil & Gas Corp. (MGY), Thermon Group Holdings (THR) and Astrana Health (ASTH).

Magnolia Oil & Gas is a small-cap exploration and production company based in the Eagle Ford shale region. The company has a strong and experienced management team with a disciplined capital-allocation framework, owner mindset and strong balance sheet. Further, the company’s low wellhead breakeven numbers and low debt levels make it an attractive, relatively lower-risk opportunity to gain exposure to the commodities cycle’s upside.

Thermon Group Holdings is a global leader in highly engineered process heat solutions serving diverse end markets globally with a full suite of mission-critical products for some of the industry’s most complex projects. Thermon has a long-tenured base of over 10,000 customers — including some of the world’s most sophisticated businesses — to whom it provides products to keep operations running and functioning safely.

Astrana Health is a leading health care provider in select US markets. Its emphasis on value-based care incentivizes physicians to focus on long-term quality and spending rather than performing more services. The opportunity to enter new markets, take more risk on its patient panel and organically add physicians and patients to its network should result in a long growth runway for Astrana. We capitalized on what we consider a reasonable valuation to initiate a new position in the quarter.

We funded these acquisitions in part with the proceeds from the sale of our position in shipping and transportation company Kirby Corporation.

Market Outlook

Strong corporate earnings and economic growth continued in Q2, which helped bring the Russell 1000 Index’s year-to-date performance to +14.2%. However, the market has narrowed again, with a large portion of returns driven by a small handful of mega-cap tech stocks. Nearly two-thirds of this year’s return has been driven by six stocks: NVIDIA, Meta Platforms, Microsoft, Alphabet, Amazon and Apple. Year to date, NVIDIA (NVDA) alone has contributed nearly one-third of equity market returns with its +150% increase.

Over the past 10 years, growth indices’ outperformance relative to value indices has been astounding at over 8 percentage points annually. However, it is interesting to note this has not been driven by value’s poor performance. On the contrary, the Russell 1000 Value Index has increased more than 8% annually over the past 10 years — in the range of long-term equity returns.

Like the performance disparity among growth and value indices, small caps continue to underperform large caps. Year to date, small caps have underperformed by more than 12 percentage points, and over the past 10 years, they have underperformed by about 5.5 percentage points, annualized. By some measures, small caps are trading near a historically low valuation premium relative to large caps.

While this combination of high valuations and narrowing breadth may make for a rather bleak outlook for investors, we believe it offers a compelling backdrop against

which to be small company investors. Given the relative underperformance of small-cap indices over the last decade — and particularly over the last three years, which have seen negative annualized returns — we think the outlook over the intermediate to long term is highly constructive and would anticipate an environment in which resilient, undervalued, small companies can perform well, if not outperform their mid- and larger-cap counterparts. As such, we maintain our diligent focus on executing our fundamentally oriented, bottom-up strategy, which aims to find such well-positioned yet overlooked investment opportunities.

Our primary focus is always on achieving value-added results for our existing clients, and we believe we can achieve better-than-market returns over the next five years through active portfolio management.