Adam Smigielski

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the fourth week of August. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

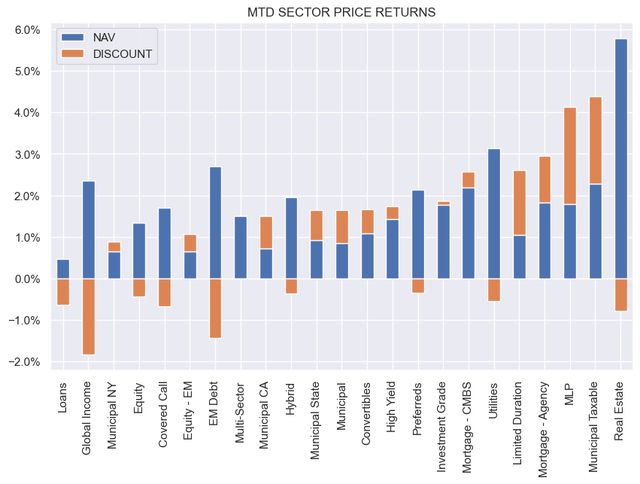

Nearly all CEF sectors finished in the green on the week, supported by Fed rate cut expectations.

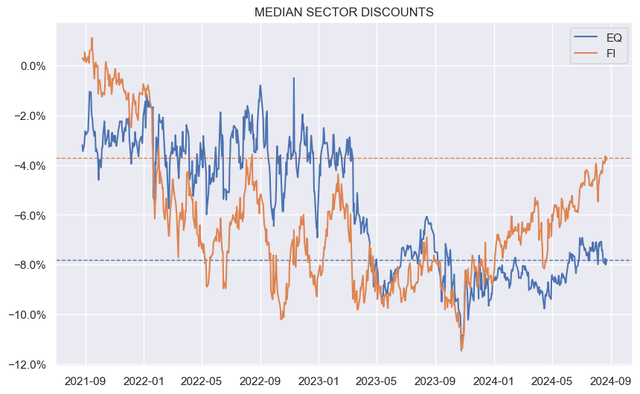

Fixed-income CEF sector discounts continue to tighten, while equity CEF discounts have stalled. This wide gap between the two is fairly unusual historically.

Market Themes

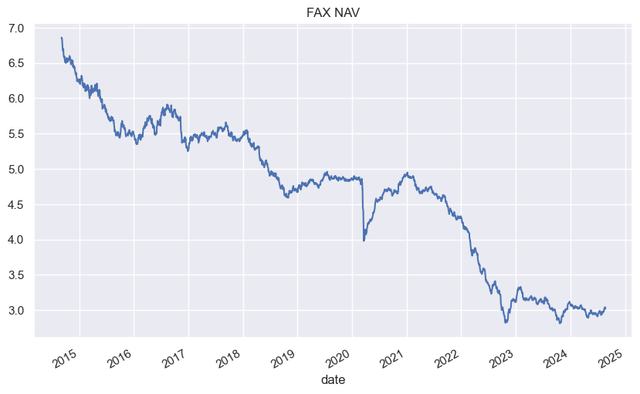

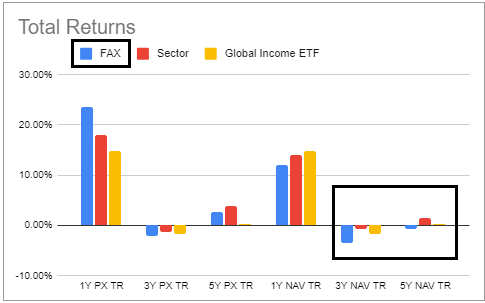

An abrdn Asia-Pacific Income Fund (FAX) is doing a 1:6 reverse stock split. This is what happens when a fund generates little to no wealth but has a double-digit distribution.

The fund has done as well as the company’s rebranding from Aberdeen Asset Management to abrdn, i.e. badly. Total NAV returns over the longer time frames are negative.

Systematic Income CEF Tool

Their CEF (ACP) is another shocker from the company – this one in the High Yield sector. The company’s funds tend to be the worst performers in their respective sectors and should generally be avoided at all costs.

Market Commentary

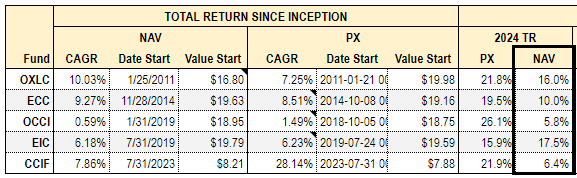

CLO equity CEFs have released their July NAVs. The numbers are mixed – OXLC, CCIF and EIC are down while ECC and OCCI are up. Total NAV return this year is fairly divergent – OCCI and CCIF are at the lower end of around 6% then ECC around 10% and OXLC and EIC at 16-17%.

Systematic Income CEF Tool

EIC continues to outperform ECC and the overall sector for the second year, which is odd as EIC has a lower-yield profile with a chunk in CLO Debt securities. Perhaps the high level of distressed exchanges are eating into CLO Equity performance and are offsetting high income levels. Valuation is all over the place and doesn’t align with performance. EIC is fairly cheap at a flat discount. The fund has turned it around after struggling for a few years and is the strongest performer in the sector over the last couple of years. CCIF is expensive at a 12% premium.

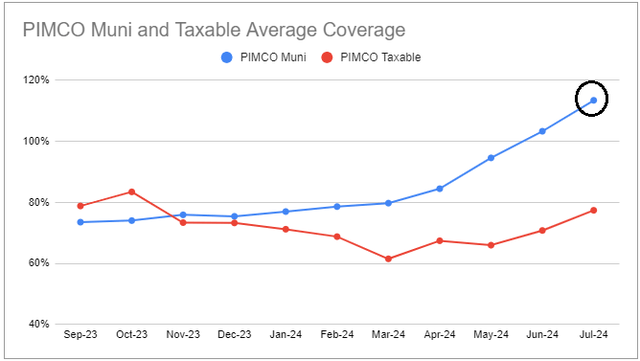

CEF coverage was updated on the Coverage tab of the CEF Tool. The one surprise was the increase in PIMCO Muni CEF coverage.

The likely driver is the retirement of almost all of the auction-rate preferreds. Replacing these with variable-rate term preferreds would have saved the funds 1-2% in leverage costs. However, it wouldn’t explain the sharp move-up in income. We should know more once the shareholder report comes out.

Nuveen said NRK shareholders did not approve the nominees proposed by Karpus. Karpus held around 21m shares or about a quarter of the fund. Karpus proposed its own nominees to the board and had a proposal to terminate the advisory agreement between Nuveen and NRK. Fairly disappointing for Karpus to not get a third of the remaining votes, though Saba did not have a better result with BlackRock funds.

Nuveen preferred CEF JPI hiked its distribution to match that of JPC. Recall that this was previously a term CEF, which has now turned into a perpetual one. It’s very likely JPI and JPC will merge, as happened with JPS and JPT previously. JPI wasn’t merged because it was going through the termination process. Now, with no term CEFs in the Nuveen preferred suite, the family is not very interesting. Their leverage caps mean they are much more likely to go through forced deleveragings, selling low and buying back high, something which has kept their total NAV returns at unimpressive levels. Usual suspects like LDP and PFO are more attractive in the sector.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!