Richard Drury

With interest rates possibly beginning to decline sometime in 2024, income investors have been looking at high yield fixed income vehicles.

The challenge there is sorting through the good, the bad, and the ugly, but there are many debt CEFs, such as Ares Dynamic Credit Allocation Fund (NYSE:ARDC), which have veteran managers who make those decisions.

Fund Profile:

ARDC’s investment objective is to provide an attractive level of total return, primarily through current income and, secondarily, through capital appreciation.

The Fund invests primarily in a broad, dynamically managed portfolio of (i) (“Senior Loans”) made primarily to companies whose debt is rated below investment grade; (ii) corporate bonds (“Corporate Bonds”) that are primarily high yield issues rated below investment grade; (iii) other fixed-income instruments of a similar nature that may be represented by derivatives; and (iv) securities of collateralized loan obligations (“CLOs”). (ARDC site)

ARDC’s inception date was 11/7/12.

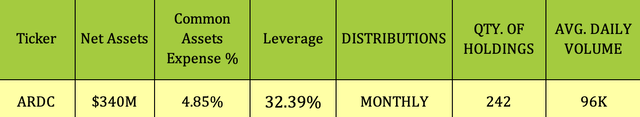

ARDC uses leverage, at 32.39%, which added 2.42% to its expense ratio, for a total of 4.85%. It pays monthly distributions, and holds 242 positions, with daily volume of 96K:

Hidden Dividend Stocks Plus

Dividends:

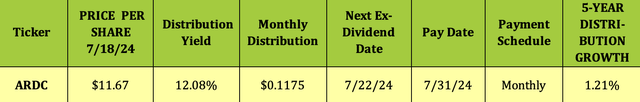

At $11.67, ARDC yields 12.08%, based upon its most recent payout of $0.1175, which goes ex-dividend on 7/22/24, with a 7/31/24 pay date.

ARDC has a modest five-year dividend growth rate of 1.21%. Management last raised the monthly payout in August 2023, when it rose from $.1125 to the present $.1175. That was the second hike in 2023.

Hidden Dividend Stocks Plus

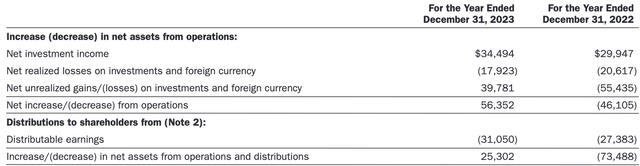

ARDC had NII of $34.49M in 2023, vs. $31.05M in distributions, a 1.11X coverage factor, an improvement over 2022, when its NII coverage factor was 1.09X. Net Unrealized Gains swung to a $39.78M gain in 2023, vs. a $55.43M loss in 2022. Net assets increased by $25.3M in 2023, vs. -$73.5M in 2022:

ARDC site

Taxes:

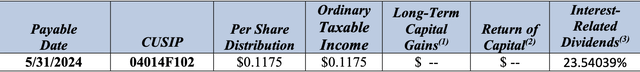

ARDC’s most recent 19a notice lists its May distribution as being ordinary taxable income, and lists 23.54% as being Interest-Related Dividends, Qualified Interest Income.

ARDC site

Holdings:

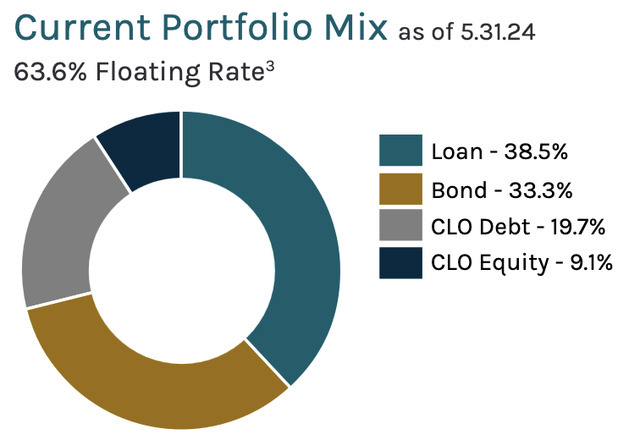

ARDC’s portfolio was comprised of 38.5% Loans, 33.3% Bonds, 19.7% CLO Debt, and 9.1% CLO Equity, as of 5/31/24:

ARDC site

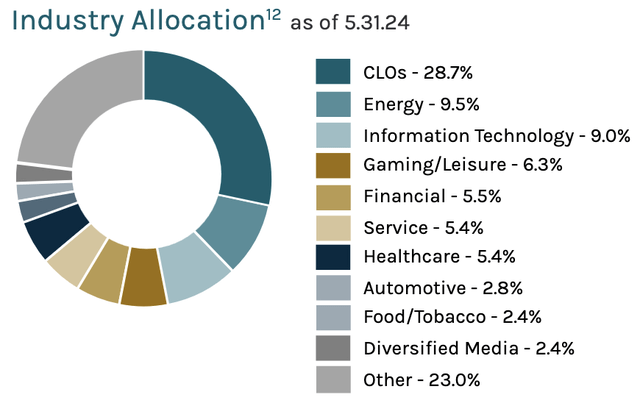

Following CLO’s, at 28.7%, ARDC’s biggest industry exposures run from Diversified Media, at 2.4%, up to Energy and Tech, at 9.5% and 9%, respectively.

ARDC site

Its top 10 holdings form ~10% of its portfolio, with some well-known big cap names, such as Ford Motor Credit, HCA Healthcare, and Williams Bros.

ARDC site

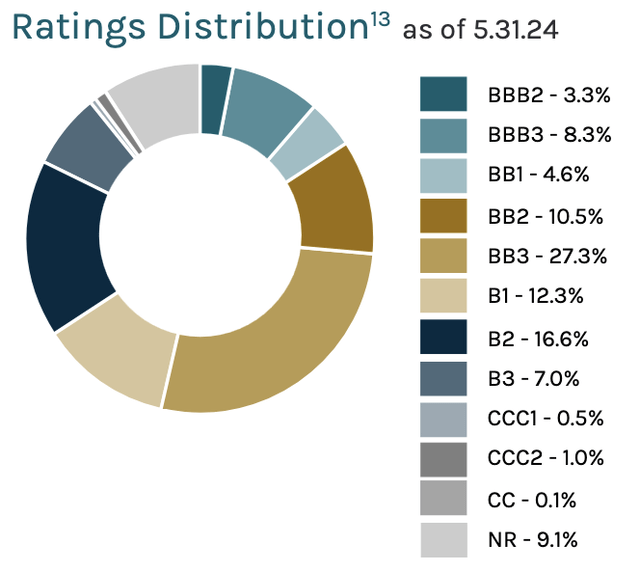

The BB2-BB3 tranches form the biggest exposure, at 10.5% and 27.3%, respectively, followed by B2 and B1.

ARDC site

Performance:

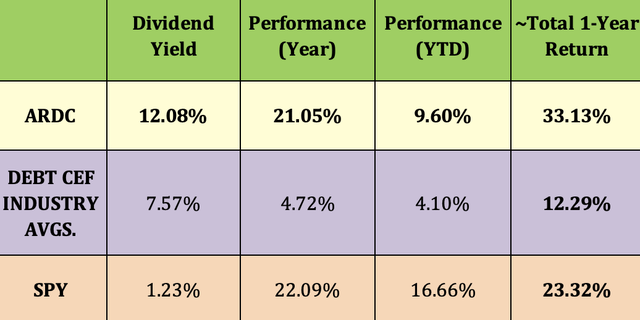

With the ongoing expectation for declining interest rates, ARDC has outperformed its industry by wide margins over the past year and so far, in 2024. Its one-year total return also outperformed that of the S&P 500 thanks to its 12% yield:

Hidden Dividend Stocks Plus

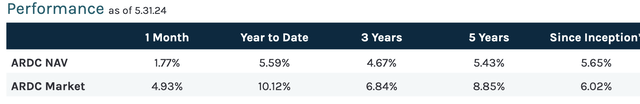

Looking back further, it has a 4.67% 3-year NAV return, a 6.84% market return, a bit less than its five-year returns of 5.43% and 8.85%, and its returns since inception of 5.65% and 6.02%:

ARDC site

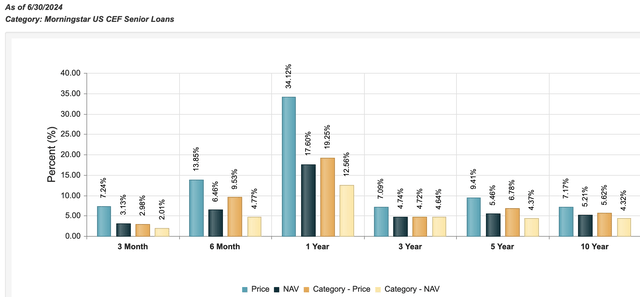

ARDC has outperformed the Morningstar US CEF Senior Loan category over the past quarter, six months, and over the past one-, three-, five-year periods, as well as since its 2012 inception:

ARDC site

Valuations:

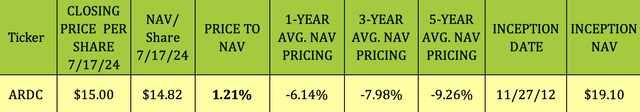

Buying CEFs at a deeper discount than their historical average discounts/premiums can be a useful strategy, due to mean reversion.

CEFs’ daily NAV/share valuations are calculated after the market close.

As of the 7/17/24 close, ARDC was selling at a 1.21% premium to NAV, much higher than its one-, three-, and five-year discounts, which ranged from ~6% to over 9%:

Hidden Dividend Stocks Plus

Parting Thoughts:

We rate ARDC a Hold due to its premium price to NAV, which is much higher than its historical averages. However, put this one on your watch list, it has good long-term performance vs. its peers. You may be able to buy it at a reasonable discount in the next big market pullback.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.