Bjoern Wylezich

Investment Thesis

Air Products (NYSE: NYSE:APD) is the global leader in providing industrial gases and process technologies to over 30 industries. APD products cover the production and supply of gases such as atmospheric and process gases (hydrogen, Helium, and Carbon monoxide). In recent years, APD is in the active process of shifting to clean hydrogen energy at scale while divesting its traditional energy, as indicated by its recent sales of the LNG business unit for $1.8 billion.

As discussed in my previous coverage on Plug Power (NASDAQ: PLUG), the hydrogen economy is growing at a high single-digit pace until 2030, primarily fueled by the demands for green and blue hydrogen under the global decarbonization agenda. hydrogen is essential for everything that cannot be electrified, acting as a “clean fuel”. As such, the pivot of APD is undeniably reasonable. However, the rapid shift to hydrogen, which now accounts for more than 70% of the backlog, is a risky move that adds more volatility to the company. As such, the rating to the company is a Hold. More analysis will be provided below.

APD’s position in the shift towards hydrogen energy

APD is ambitious about maintaining the lead in hydrogen production by developing world-scale hydrogen megaprojects in the US, Canada, and Saudi Arabia. Air Products has the technology and the expertise needed to provide cleaner energy for the future. Investing in hydrogen production is consistent with the primary motive of the company’s drive for sustainable growth as its core strategy for growth in clean energy alternatives. Air Products’ management is actively implementing its vision of a sustainable approach to driving the energy transition through hydrogen megaprojects.

The company wants investors to see itself as a committed leader:

Commitment

APD has invested $15 billion in projects worldwide. APD is accelerating the hydrogen transition by providing hydrogen infrastructure. The president and Chief Executive Officer, Seifi Ghasemi reaffirmed to investors that “APD is firmly focused on reducing its costs and pricing despite the existing geopolitical challenges to execute the total energy transition to low and zero-carbon hydrogen projects in the world.”

Visionary role

APD, with 65 years of hydrogen experience, is at the very forefront of driving the global shift to hydrogen. This is exemplified by a partnership with NEOM Green hydrogen Company, which builds the world’s largest green hydrogen production facility located in NEOM’s Oxagon region at a value of $8.4 billion. APD works with NEOM as a contractor for engineering, procurement, and construction (EPC) and system integrator for the entire facility is an intentional decision in facilitating the fast shift to hydrogen. NEOM City is “a vision of what the future looks like” – so as the company’s vision to drive transformation of the future of energy

More tractions in green energy business segments

-

After California adopted approaches towards achieving a 100% energy transition to zero-emission, APD is actively implementing a network of hydrogen refuelling stations that refuel over 2,000 light-duty vehicles and 2000 heavy-duty trucks.

-

The company has committed $15 billion to hydrogen production and supply in scale in its various locations. The focus is on offering a cheaper alternative to fossil fuels, such as heavy-duty transportation and manufacturing.

-

APD has contracted with Chengzhi Shareholding Co. Ltd, a high-tech Chinese state-owned industry group, to accelerate transport decarbonization in China’s Yangtze River Delta. The Joint Venture aims to start its commercial-scale hydrogen refuelling stations in Changshu, Jiangsu province, for city heavy-duty trucks and buses.

Air Products

Decarbonizing Heavy Industries

APD signed an agreement with TotalEnergies for the delivery of Green hydrogen with the aim of supplying 70,000 tons of hydrogen annually beginning in 2030. The first long-term deal in this contract with TotalEnergies seeks to supply 500,000 tons per year of hydrogen to decarbonise TotalEnergies Refineries in Europe. This is an opportunity for an investor to get into the market and move with the imminent rise in the hydrogen energy business.

These strategic investments and collaborations accompany the heavy manufacturing of hydrogen-powered vehicles that demand efficient and affordable hydrogen energy. This presents an opportunity for opportunists to invest in the future of energy.

Valuation: Better prospect comes with higher risks

As a believer in the future of hydrogen, what Air Products is doing strategically presents an optimistic picture to me – standing at the forefront of energy transition and leading the industry peers by radically transformation.

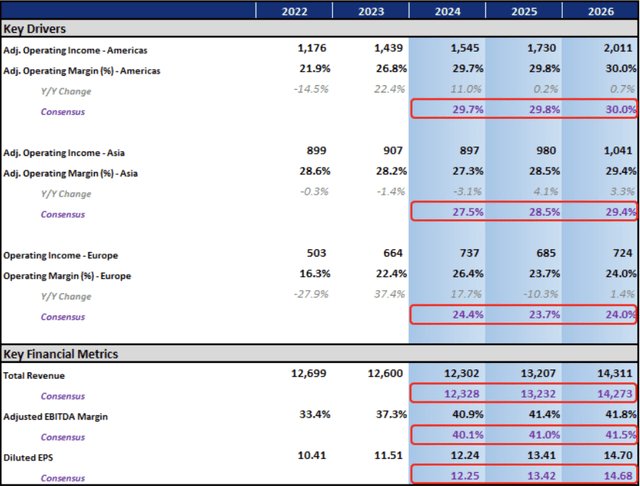

This is reflected in the model below in which the revenue and total operating income of the company is forecast to grow between 8 – 10% every year until 2026. This is assumed that, while rapidly expanding, the hydrogen industry requires time to grow and mature before steady revenue comes in. On the other hand, profit margin will slightly expand following the higher operating expenses in the process of the pivot, reaching 41.5% EBITDA Margin.

Data from Bloomberg and the author

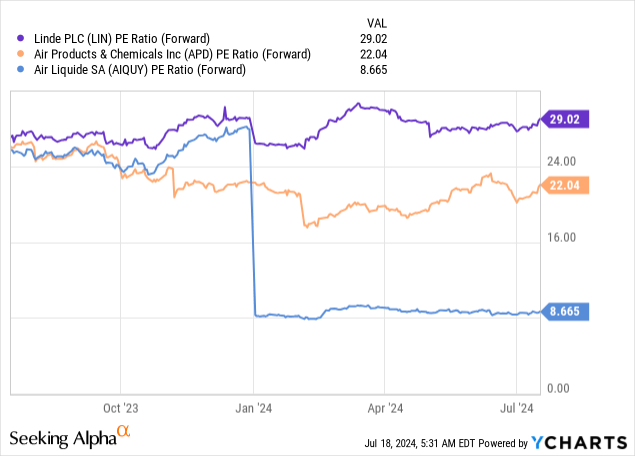

In terms of valuation multiple, Air Products’ P/E ratio was affected by the company’s pivotal decision to develop in the hydrogen industry, which reflects investors’ initial concerns on the company. But as more partnerships being announced and backlog growing, the valuation multiple is enhanced gradually. This also reflects my view that as the uncertainties around hydrogen economy fade, the company can reach an even higher multiple closer to its closest peer Linde, which is at the 23 – 25x range.

All valuation metrics look good so far, except there is a problem – the risks of the company are higher since the company is developing and transitioning into a whole new sector which is still at a very early stage. Also, the company is reportedly reluctant to sign a traditional offtake agreement that secures a stable income.

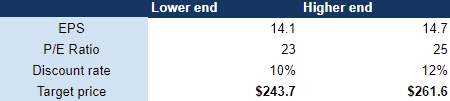

Consequently, the higher risks and expected returns are reflected in the higher discount rate, which should be applied at around 12 – 15%, taking into account the higher risk free rate and the higher cost of debt for its around $10 billion long-term debt.

Image created by the author

This gives us a price range from around $245 – $260. Therefore, it is a Hold to us as the company is more or less rightly priced at the moment.

Investment Risks

-

Regulatory Uncertainties: Governments are introducing friendly regulations such as funding programs and incentives in support of green hydrogen projects. For example, the US Inflation Reduction Act (IRA) includes the Clean hydrogen Production Tax Credit to drive the hydrogen economy. This is financial support for hydrogen production and hydrogen infrastructure that will scale hydrogen stocks, but as the industry matures, the cancellation of subsidies may negatively affect APD.

-

Technology risks: hydrogen is still in the early stages of adoption and will probably take 5-10 years to prove itself. The production of hydrogen includes complicated processes and types of technology, such as electrolysis or pyrolysis. Therefore, different paths and advancement of technologies may impact make APD’s products obsolete and less cost efficient

-

Intense competitions: Plug Power, which produces hydrogen fuel cells, is a serious competitor for battery-powered EVs as opposed to APD. Also there is Ballard Power Systems (NASDAQ: BLDP), a power fuel cell manufacturer for automobiles as a close competitor of APD. As the industry grows, the competition in technology and pricing may be more intense and affect the sales and margin of APD.

Conclusion

To conclude, Air Products is leading to capitalize on the growing hydrogen economy via its investments and strategic partnerships, as well as forward-looking divestment. However, the radical transition does not give investors confidence as hydrogen sector is still at its innings. As such, reflecting both the future potentials and the associated risks, the company is a Hold to us, until more certainties and stability show.