J Studios/DigitalVision via Getty Images

Long-time readers know I’ve been bullish on short-term and variable rate bonds since mid-2021, as skyrocketing inflation was almost certainly going to result in higher rates. I’ve been bullish on senior loan ETFs too, including the benchmark Invesco Senior Loan ETF (NYSEARCA:NYSEARCA:BKLN), in spite of their high expense ratios, as economic conditions seemed favorable enough to overcome their expenses.

Economic conditions seemed to have stabilized by now, with below-target inflation and (almost certain) rate cuts in the coming months. Under these conditions, senior loans are unlikely to materially outperform, BKLN’s 0.65% expense ratio is an important drag on its performance, and a deal-breaker for me. As such, I would not be investing in the fund at the present time.

BKLN – Overview and Analysis

Strategy and Portfolio

BKLN is an index ETF focusing on senior loans, which are almost always senior secured variable rate loans from non-investment grade corporations. BKLN’s underlying index is quite broad, so the fund should move alongside senior loans as an asset class, without significant under or overperformance.

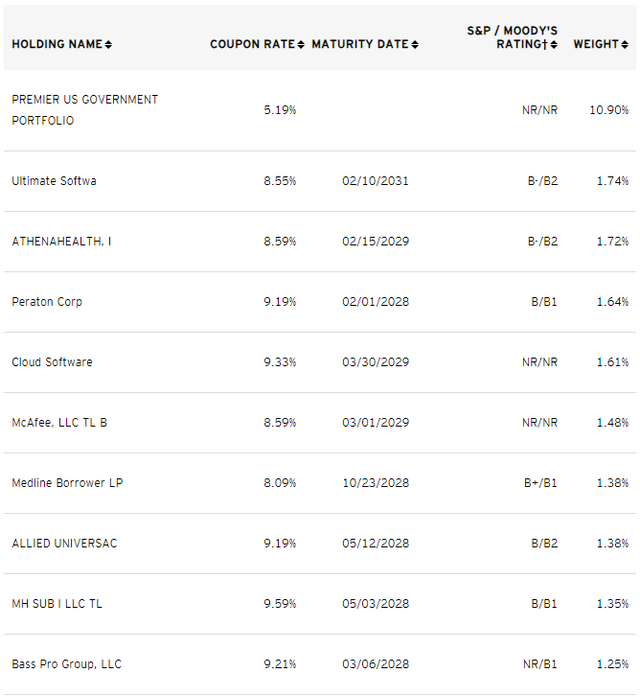

BKLN currently invests in over 160 loans. Largest of these are as follows:

Interest Rate Risk

Some context first.

Most bonds are fixed-rate bonds, and so pay the same coupon from issuance until maturity. Buy a 4.25% yielding 10y treasury today, and you will receive 4.25% in income every year for the next ten years, regardless of what the Fed or the market does.

Rates on treasuries issued in the future might change though. Significant rate cuts later in the year would almost certainly lead to lower coupon rates for treasuries issued later in the year, older issuers would retain their higher rates. Investor demand for these older, higher-yielding treasuries would increase, leading to higher prices. Bond funds invariably focus on older bonds, and so would see capital gains / higher share prices from significant rate cuts.

Lower rates would have the opposite effect.

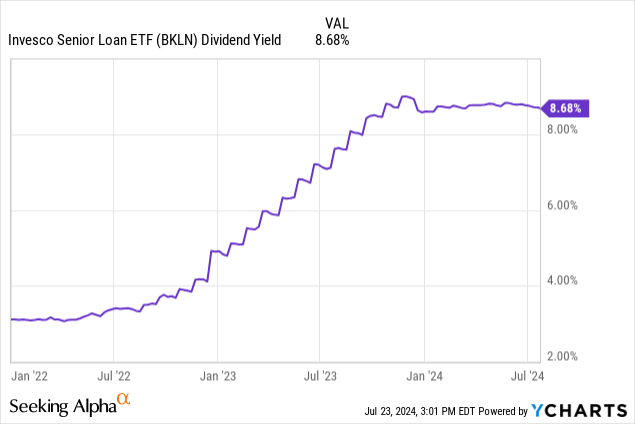

Senior loans are not fixed-rate investments, but variable. Simplifying things a bit, senior loans are indexed to specific benchmark rates, and see higher coupon rates when the Fed hikes, and vice versa. BKLN’s yield has increased by 5.7% since the Fed started to hike, broadly in-line with Fed hikes.

Data by YCharts

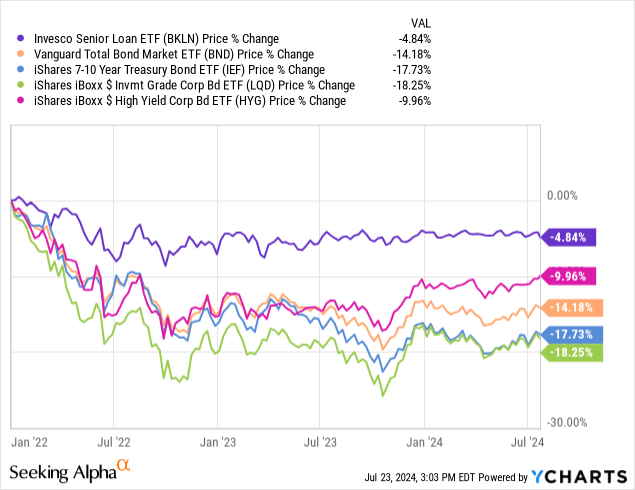

Due to the above, senior loan prices are not significantly impacted by changes in interest rates. As an example, BKLN’s share price is down only 4.8% since early 2022, compared to double-digit declines for most bonds and bond sub-asset classes.

Data by YCharts

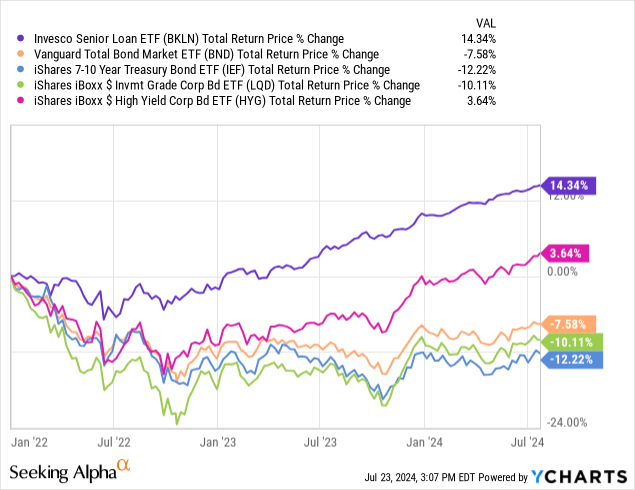

Senior loans tend to outperform when rates rise, as has been the case since early 2022.

Data by YCharts

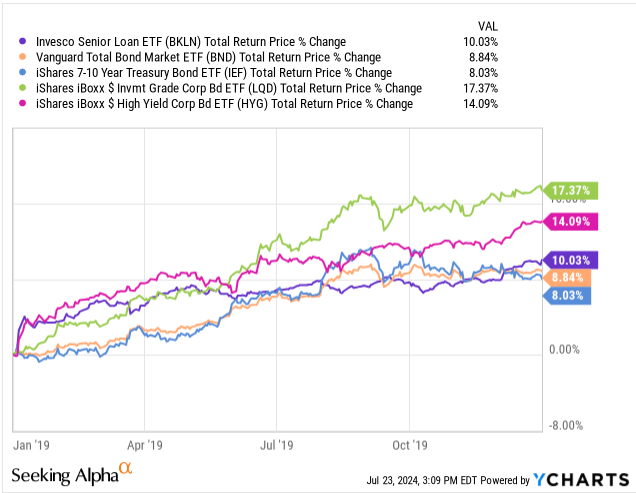

On the flipside, senior loans tend to underperform when rates decrease. Excluding the pandemic, last time rates were down was in 2022, during which BKLN underperformed fixed-rate bonds of comparable credit quality (high-yield bonds). It outperformed most bonds and treasuries though, due to its above-average yield and credit spreads tightening. Rates are definitely not the only consideration, but definitely an important one.

Data by YCharts

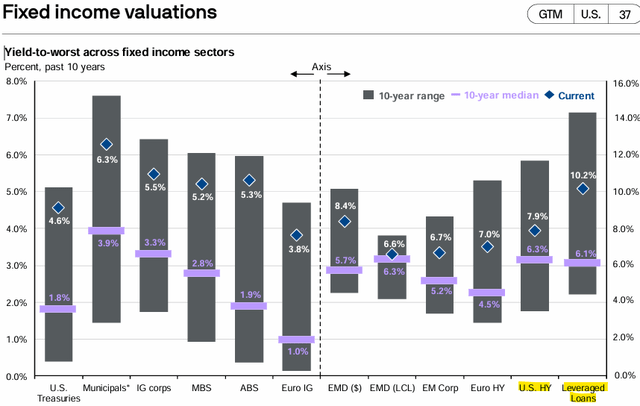

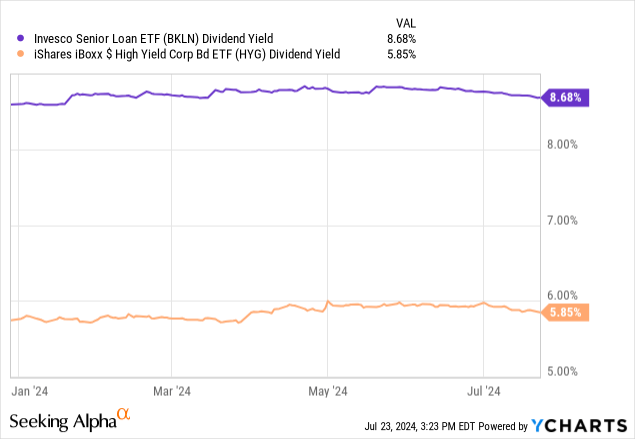

Senior loan and BKLN’s yield are both set to decline as the Federal Reserve cuts rates later in the year. Both trade with sizable spreads relative to high-yield bonds too, sizable enough that yields should remain competitive for a few years. As per JPMorgan, spreads are at 2.3%.

BKLN itself yields 2.8% more than the largest high-yield bond ETF (spreads are tighter for some of its peers though).

Data by YCharts

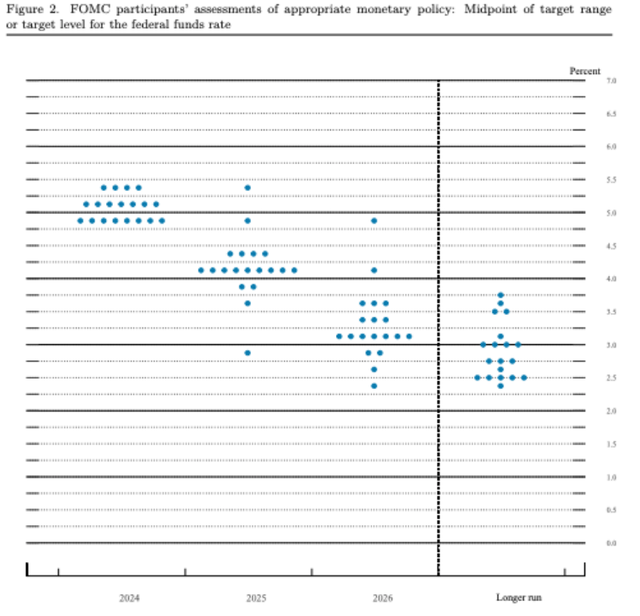

Current Fed guidance implies senior loans continuing to out-yield bonds until at least 2026, perhaps long-term.

Under current market conditions, and considering Fed guidance, senior loans could continue to perform quite well even as the Fed cuts rates later in the year. Yields should remain higher than average for several years, which should help stabilize share prices. High-yield bonds would almost certainly outperform if rates plummet, but not if these remain higher for longer, or see slow, methodical cuts.

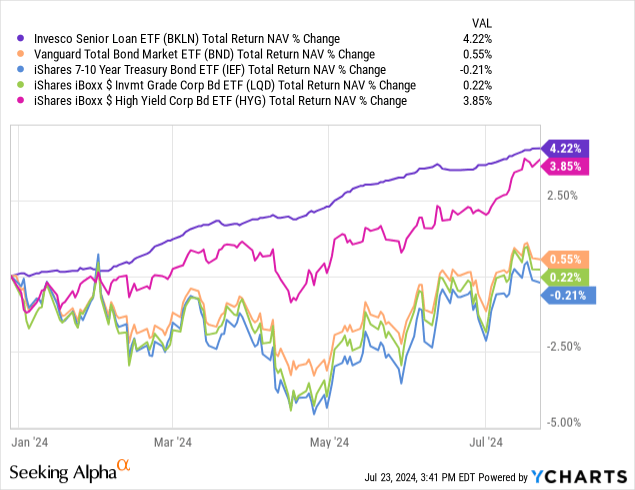

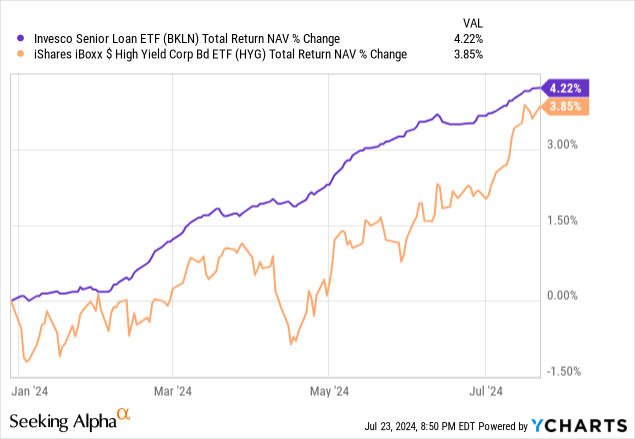

As a (partial) example of the above, BKLN has outperformed most bonds and bond sub-asset classes YTD even though rates are flat. Outperformance could certainly continue if rates are only cut 0.25% – 0.50%, but more significant rate cuts would put much greater pressure on the fund’s performance.

Data by YCharts

Credit Risk

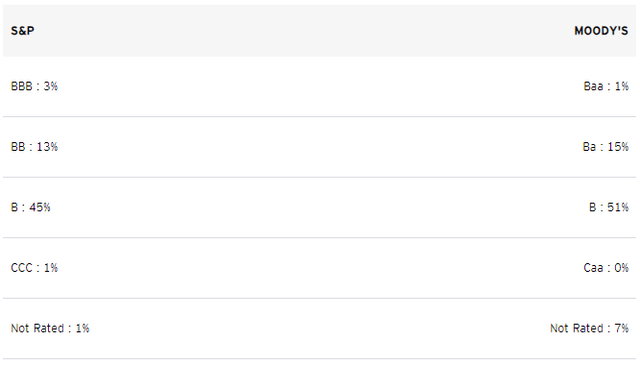

BKLN focuses on non-investment grade loans, with these accounting for 97% – 99% of its portfolio, and with an average credit rating of B. Overall credit quality is low and below-average, although not excessively so.

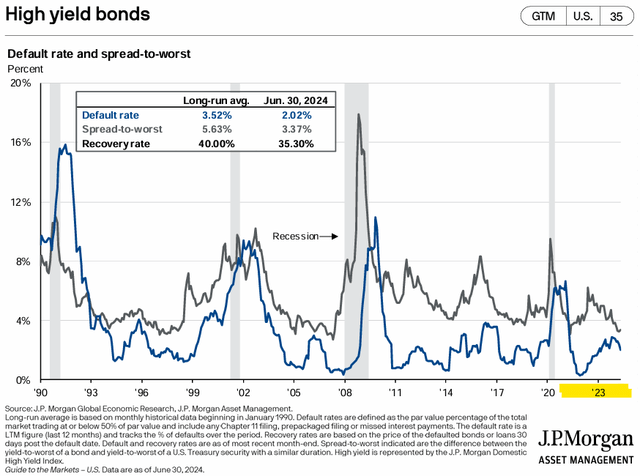

Current economic conditions favor high-quality investment-grade investments and securities, not BKLN’s low-quality loans. Specifically, credit spreads have tightened as default rates rise, meaning these riskier loans are seeing higher risks, lower (comparative) yields, and below-average risk-adjusted returns and yields. Data as per JPMorgan, focus on the lower left of the graph.

The above is an important negative for the fund, and disadvantage relative to higher-quality variable rate ETFs, including the Janus Henderson AAA CLO ETF(JAAA) and the Janus Henderson B-BBB CLO ETF (JBBB).

Expense Ratio

BKLN has an expense ratio of 0.65%, higher than average for an index ETF, and much higher than that of several strong ETFs. The SPDR Portfolio High Yield Bond ETF (SPHY), for instance, has an expense ratio of only 0.05%. JBBB costs 0.49%, comfortably lower than BKLN, even though CLOs are somewhat niche investments (less competition, less pressure on fees). Senior loan ETFs are generally pricey, with the Franklin Senior Loan ETF (FLBL) having the lowest expense ratio of 0.45%.

I’ve always considered BKLN’s expense ratio to be a significant negative, as it necessarily leads to lower yields and returns to shareholders. The fact that expenses are a certain negative is important. There is a lot of uncertainty when investing: valuations might never improve, dividends might get cut, the Fed might cut or hike rates, and economic conditions might improve or worsen. Expenses are always a negative, so avoiding expensive funds is almost always helpful. Sufficiently favorable economic conditions might outweigh high expenses, they did for me earlier in the year, but conditions are simply not favorable enough. As such, and in my opinion, I would not be investing in senior loans or BKLN right now.

BKLN – Looking Back

I last covered BKLN earlier in the year. I was bullish then, more neutral now, so thought to explain my reasoning.

In short, spreads have tightened, interest rate cuts are nearer, and uncertainty regarding inflation and the pace of rate cuts has decreased. These changes make senior loans less attractive investments than before and have caused my opinion on these to change.

Another issue is that conditions YTD have been somewhat favorable to senior loans, and BKLN has barely outperformed high-yield bonds since. Conditions would have to improve for performance to do the same, and I don’t simply don’t see how that could happen.

Data by YCharts

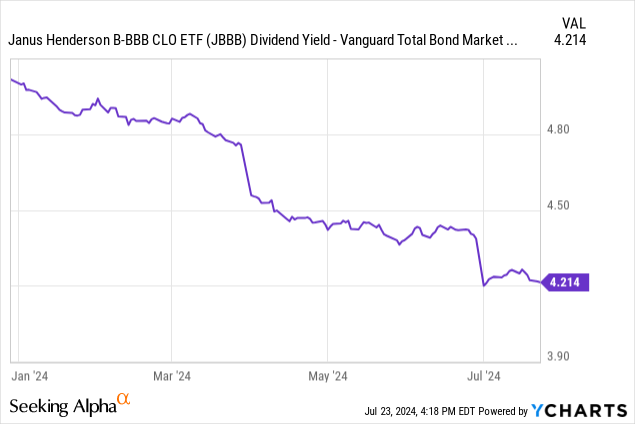

I remain bullish on cheaper, higher-quality variable rate ETFs though, as these do trade with healthy spreads relative to fixed-rate peers. As an example, JBBB’s 7.6% dividend yield is around 4.2% higher than that of most bonds. Guidance is for less than 4.2% in long-term cuts, so JBBB’s dividend yield should remain competitive long-term. Similar situation for several other ETFs in this space, including JAAA and CLOZ.

Data by YCharts

Conclusion

BKLN is an index ETF focusing on senior loans. BKLN’s above-average 0.65% expense ratio is a material drag on its performance, and a deal-breaker for me.