da-kuk/E+ via Getty Images

Introduction

The recent pullback of the technology sector in the stock market may prove to be a good opportunity for income investors to look into growth income funds and get into the secular growth exposures.

The secular growth trend of “AI chip rush” will continue for years to come. BlackRock Science and Technology Term Trust (NYSE:BSTZ) is offering an excellent alternative for the interested investors to tap into such AI growth opportunities. It has a portfolio with heavy weights in the semiconductor industry, including AI chip leader NVIDIA representing over 10% of the portfolio. The fund share price is cheap with an 11% NAV discount. The fund recently raised its dividend, reaching 12.99% yield. The high distribution is super attractive to income seekers who want to extend their income portfolio to the fast growth areas. The best thing is that they will get paid well while waiting for the recovery of the technology and chip industry markets.

BSTZ Fund Overview

BSTZ is a term trust fund managed by BlackRock. The fund has the following official description about “investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation.“

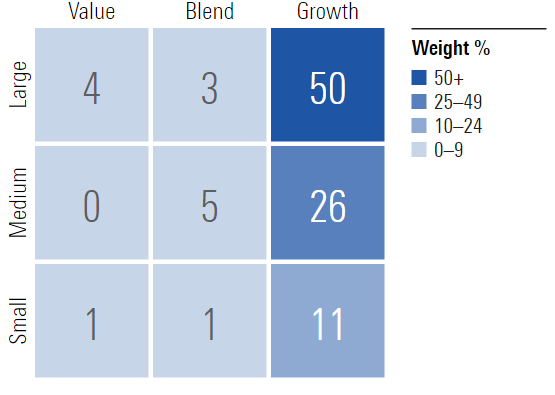

What is special about BSTZ is that the fund has an all-technology portfolio with a total of 261 holdings. The following shows its weight breakdown, where 50% is centered in the Large and Growth category.

BSTZ Weight Breakdown – from Morningstar.com

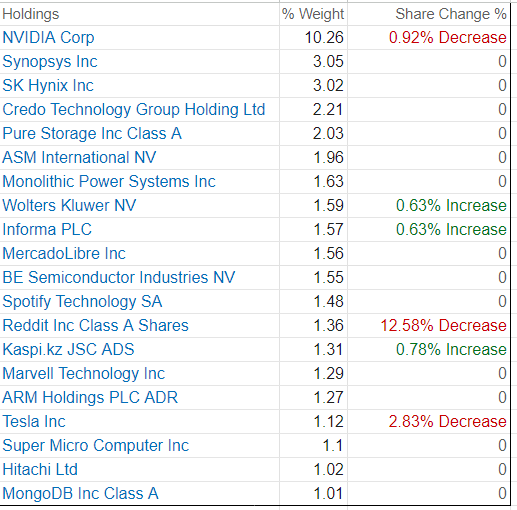

The top 5 holdings account for 20.5%, and they are all in the Semiconductors industry. In fact, there are many others in the top 20 (with weight larger than 1) such as #7 and #8, which are in the same Semiconductors industry, as shown below:

BSTZ Top 20 Holdings – Author compiled from Morningstar.com

The chip-bias shows a good understanding of the management team in the hot AI market, which makes the fund uniquely positioned and different from the other technology-focused fund like its sister fund BlackRock Science and Technology Trust (BST).

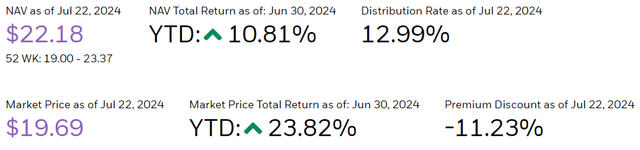

The following summarizes some key market characteristics of BSTZ, followed by BST CEF for comparison.

- Total Assets (AUM) $1.69B. BSTZ is a large CEF.

- Volume 104,490. It is a bit light but tradeable.

- NAV (discount): 11.23%. The price is cheap. It offers good entry points.

- Yield: 12.99%. Monthly distributions have been increased since June.

- Leverage : 0.19%.

- Expense Ratio: 1.32%. It is high but typical for the managed CEF fund.

- Term: BSTZ is a 12-Year term fund, that will be ended in June 2031, subject to a perpetual similar to what got BST started.

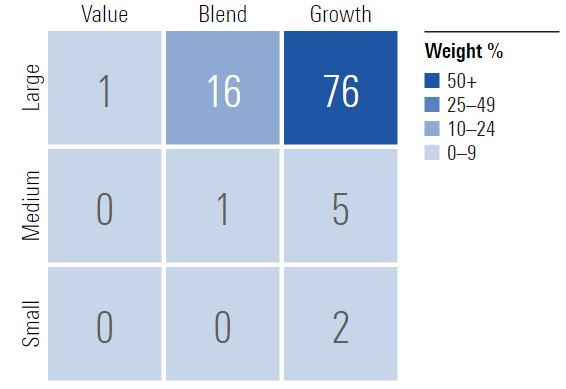

The BST fund is an CEF, also managed by BlackRock. The investment objectives are identical to what is stated for BSTZ, with the same focus on technology companies. The difference is that BST’s portfolio has more weight in the large cap growth stocks (76%), including shares of “Magnificent 7”, as shown below:

BST Weight Breakdown – from Morningstar.com

The following is a summary of BST market characteristics:

- Total Assets AUM $1.30B. BST is a large CEF but smaller than BSTZ

- Volume 94,887

- NAV (Premium): 5.34%. It is not a bargain price. It will be subject to a bigger sector correction.

- Yield: 8.29%. The distributions issued in 2024 are long term gains. This is a good sign for BSTZ in terms of fund’s returns

- Leverage (%): 0.48%

- Expense Ratio: 0.88%. It is smaller than BSTZ’s 1.32%.

BSTZ is the right growth play for income investors

Compared to BST, it should be emphasized that BSTZ is offering two significant double-digit advantages, making it an excellent buy. As shown below, the first advantage is 11% NAV discount. BSTZ price is cheap at the current level, and a NAV reverting run will produce a sizeable price appreciation. The second advantage is the 12.99% yield, which comes from a tech-heavy growth portfolio. There, it is a great time to buy some shares and lock in the 12.99% yield.

BSTZ Distribution and Discount – from BlackRock.com

As indicated earlier, BSTZ is tilted more aggressively towards fast-growing companies. The semiconductor industry is the biggest focus and weights in BSTZ’s portfolio. This has resulted in a substantial 20% weight difference (BSTZ’s 37% vs BTS’s 7%) in Medium-Cap Growth and Small-Cap Growth categories. It is expected that big-cap market pullback from small-cap rotation will have a smaller impact on BSTZ.

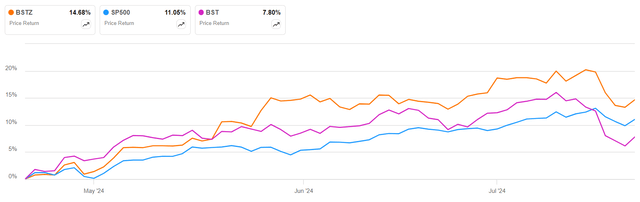

The following comparison in the last three months offers clear evidence of the different price behaviors. BSTZ has survived much better than BST during the current pullback. In fact, it is more impressive to notice that BSTZ’s price has gained (14.68) almost twice as BST (7.8%) so far in 2024. Keep in mind, this is just the price comparison, the total return will produce more gap in percentage points.

Three-Month Price Comparison – from SA charting

It is a smart move to adopt “growth income” approach.

In the near term, the big technology stocks could continue to be under the price pressures due to the (summer) seasonality and the sector rotations, including small-cap sentiment shift, such as “Small-Cap Stocks Soar Alongside Investors’ Rate-Cut Expectations“, and a potential value-oriented rotation to balance out the record-high technology concentration.

It will be a smart strategy for investors to take “profit” off from their growth portfolio until the rotations run through their courses. From the table “BSTZ Top 20 holdings” shown in the previous section, it is quite evident that BSTZ’s management has trimmed the weights in large-cap technology leaders like NVDA, TSLA, etc., perhaps as part of their trend-following actions in response to the small-cap rotation.

I think that reallocating (some portion) money to this kind of “growth income fund” makes perfect sense under the current market conditions. On one hand, the income distribution is the profit taken out every month. On the other hand, the fund management will do what is necessary to follow the market-trending sector rotations. Keep in mind that this is something you are paying (high expense ratio) for and rely on. The management should do the right job for you.

Looking ahead, I believe that the big technology guys and “real” growers will still be winners of the market in 2024. The current pullback offers a good entry point for income investors to pick up the great “growth income” plays such as BSTZ. It is also a good time to evaluate the performance against the fund strategy and structure and identify the right ones that will fit one’s investment needs. It would be a much harder job to do when everything was sun-shining. As revealed in this article, BSTZ’s AI chip overweight should separate it apart from the “FOMO” GenAI plays with “No Real AI Alpha“, which are still miles away from achieving the matching business growth.

Risks and Caveats

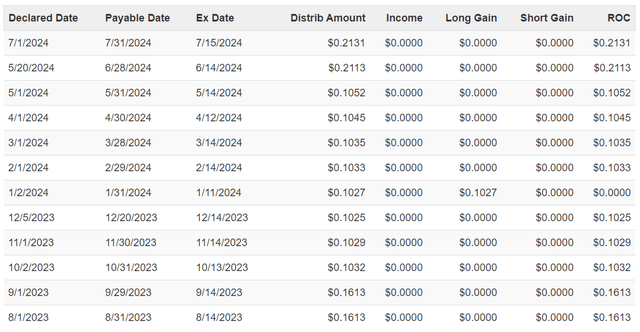

The distributions are mostly ROC as shown below, which could be a source of concern for some income investors, particularly in the light of the recent distribution raise.

BSTZ Distributions – from CEFConnect.com

The investors should also be aware of the unstable distribution history in recent months, as illustrated above. The distribution sustainability is a key gauge for the health status of the fund.

BSTZ’s portfolio is constructed with risky assets in the technology space. The portfolio will exhibit high volatilities, which could impact the fund’s performance greatly in the short run.

Closing Thoughts

The sector rotations are happening. The big technology stocks are temporarily out of the favor and have been pulled back in the last two weeks or so. For some investors, this may be a good time to take profit off the table from the growth portfolio, while others may see it as a good opportunity to create new income streams with technology exposures. Either way, BSTZ would be a smart alternative for these investors to fulfill their investment needs. BSTZ features attractive double-digit NAV discount and yield. Together with a portfolio focused on the secular-growing AI chip sector, BSTZ could be a right choice for many income investors.